Corporate Tax Registration - Timeline and Penalty

The Federal Tax Authority released Decision No. 3 of 2024, specifying the Corporate Tax (CT) registration timeline for all resident and non-resident juridical persons, as well as natural persons. Compliance is necessary to avoid penalties for late Corporate Tax Registration.

Have Your Business Registered for Corporate Tax in a Few Simple Steps!

All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax Registration Number as per the UAE Corporate tax law.

We at Darji Accounting helps businesses in getting Corporate Tax registration in UAE by making an application with Federal Tax Authority on their behalf. You must contact us, and we will guide you with all the documents and information that you need for getting registered.

Frequently Asked Questions

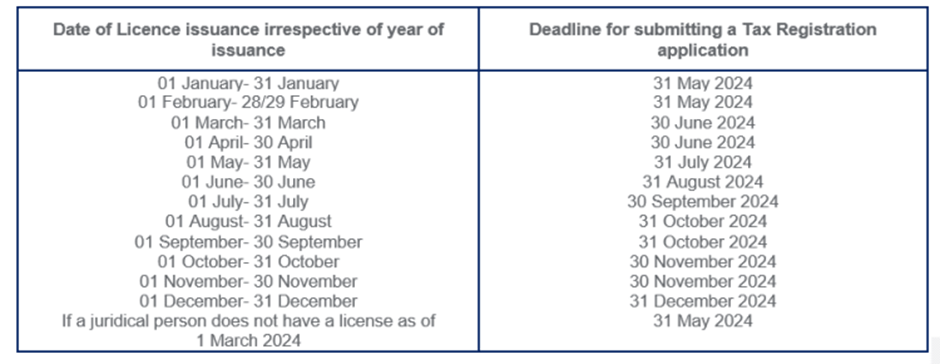

He should submit the Corporate Tax Registration application by the deadline date mentioned in the below table, irrespective of the year of issuance of the Trade license.

If a juridical person has more than one license, the license with the earliest issuance date will be used to register the juridical person for corporate tax.

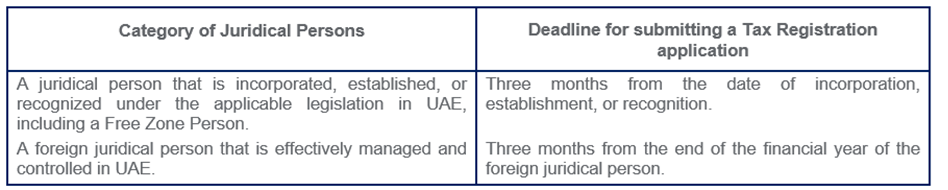

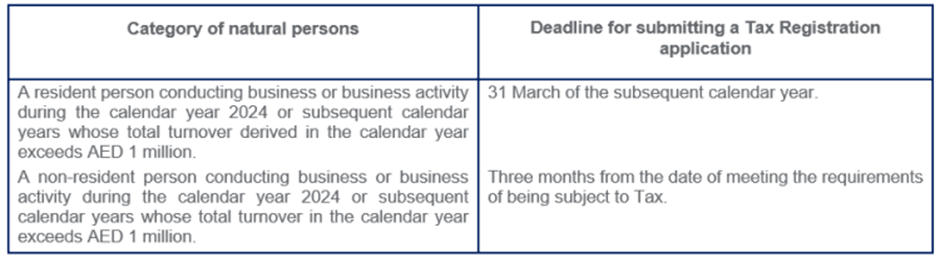

He must submit the Tax Registration application by the deadline date mentioned in the table below:

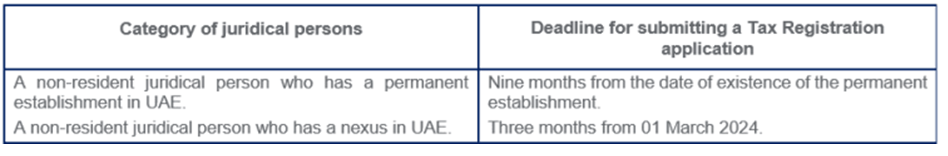

He must submit the Tax Registration application by the deadline date mentioned in the table below:

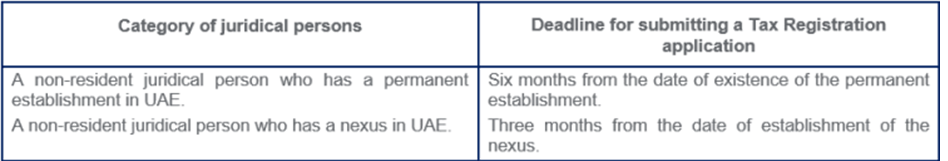

He should submit the Tax Registration application by the following table:

He should submit a Tax Registration application by the following table:

Failure to submit a Corporate Tax registration application within the specified timelines by resident juridical persons, non-resident juridical persons, and natural persons will attract a penalty of AED 10,000.

- Use the available information to determine whether your business will be subject to UAE Corporate Tax and if so, from what date.

- Understand the requirements for your business under the Corporate Tax Law, including, for example:

- Whether your business need to register for UAE Corporate Tax?

- What the Tax Period is for your business?

- By when your business would need to file a UAE Corporate Tax Return?

- What elections or applications can, or should your business make for UAE Corporate Tax purposes?

- How UAE Corporate Tax may impact your business’ obligations and liabilities under contracts with customers and suppliers.

- What financial information and records your business will need to keep for UAE Corporate Tax purposes?

- Contact our team of professional experts for consultation on Corporate Tax.

Corporate Address:

UAE

Office No. 1835, Level 18, The Burjuman Business Tower, Al Mankhool, Dubai, United Arab Emirates.

+971 56 948 1011 / +971 58 536 0434England

347, Green Street, E13 9AR, London, England.