Corporate tax in UAE

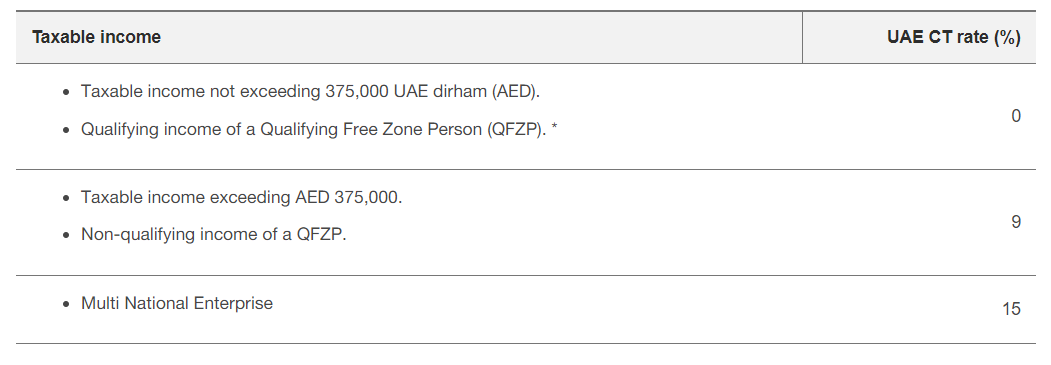

The corporate tax rate is 0% for taxable annual profit below AED 375,000 and 9% for yearly taxable profit above AED 375,000.

Have Your Business Registered for Corporate Tax in a Few Simple Steps!

All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax Registration Number as per the UAE Corporate tax law.

We at Darji Accounting helps businesses in getting Corporate Tax registration in UAE by making an application with Federal Tax Authority on their behalf. You must contact us, and we will guide you with all the documents and information that you need for getting registered.

Frequently Asked Questions

Corporate tax (CT) is a form of direct tax levied on the net income or profit of corporations and other entities from their business. Corporate Tax is sometimes also referred to as “Corporate Income Tax (CIT)” or “Business Profits Tax” in other jurisdictions.

The United Arab Emirates (UAE) has implemented a federal tax system that applies to all businesses and commercial activities operating within the seven emirates. However, there are some exceptions to this rule. For instance:

- Businesses operating in the extraction of natural resources will still be subject to the tax decrees issued by the respective Emirate.

- Individuals earning income in their personal capacity (such as salary or investment income) are exempt from taxation, as long as the income-generating activity does not require a commercial license.

- Businesses registered in Free Trade Zones are also exempt, provided that they comply with all regulatory requirements and do not conduct business with Mainland UAE.

The following income shall be in general exempt from Income Tax:

- Dividend income earned by UAE company from its qualifying shareholdings (to be defined in the law)

- Capital gains.

- Profits from group reorganization

- Profits from Intra-group transactions

There will be no UAE withholding tax on domestic and cross-border payments.

- The UAE intends to honor its commitment to businesses registered in Free Trade Zones to the extent that such businesses do not conduct business with the mainland and shall be subject to zero percent tax (or be exempt as the case may be) until the end of the holiday period. All free zones have to file an annual CT return.

- Businesses with a presence in both Mainland UAE and Free Trade Zones as well as those operating under the dual license scheme should consider the impact on their operating model.

- The OECD Transfer Pricing Rules shall now be applicable in the UAE. All companies have to comply with the Transfer Pricing rules and documentation requirements. These transfer pricing rules will now become mandatory and may also apply to domestic transactions.

- While intercompany sales and financing services are common practice amongst UAE groups, previously remuneration for these activities has not been on the forefront given the transactions would likely be eliminated upon financial consolidation.

- This is a game changer as intercompany transactions would need to be undertaken at arm’s length and generally should be supported by appropriate documentation. Businesses would need to evaluate their current arrangements and assess the impact on both cross-border as well as domestic transactions.

Corporate Tax and VAT are two different types of taxes. Both will apply in the UAE. If you are a registered business for VAT, you will have to pay VAT and Corporate Tax separately. If your business is not registered for VAT, you may still have to pay Corporate Tax.

- Use the available information to determine whether your business will be subject to UAE Corporate Tax and if so, from what date.

- Understand the requirements for your business under the Corporate Tax Law, including, for example:

- Whether your business need to register for UAE Corporate Tax?

- What the Tax Period is for your business?

- By when your business would need to file a UAE Corporate Tax Return?

- What elections or applications can, or should your business make for UAE Corporate Tax purposes?

- How UAE Corporate Tax may impact your business’ obligations and liabilities under contracts with customers and suppliers.

- What financial information and records your business will need to keep for UAE Corporate Tax purposes?

- Contact our team of professional experts for consultation on Corporate Tax.